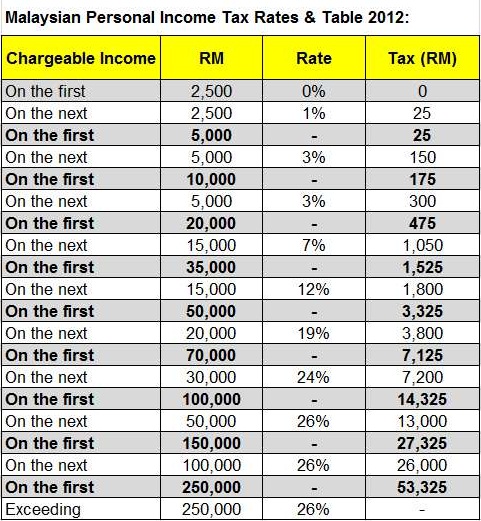

On the First 5000. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

2022 Income Tax Withholding Tables Changes Examples

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. On the First 5000 Next 15000. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

Malaysia Personal Income Tax Rate. Calculations RM Rate TaxRM 0 - 5000. These will be relevant for filing Personal income tax 2018 in Malaysia.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file.

Single Taxable Income Tax Brackets and Rates 2017. Personal income tax rates. Tax Rates 2017 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates.

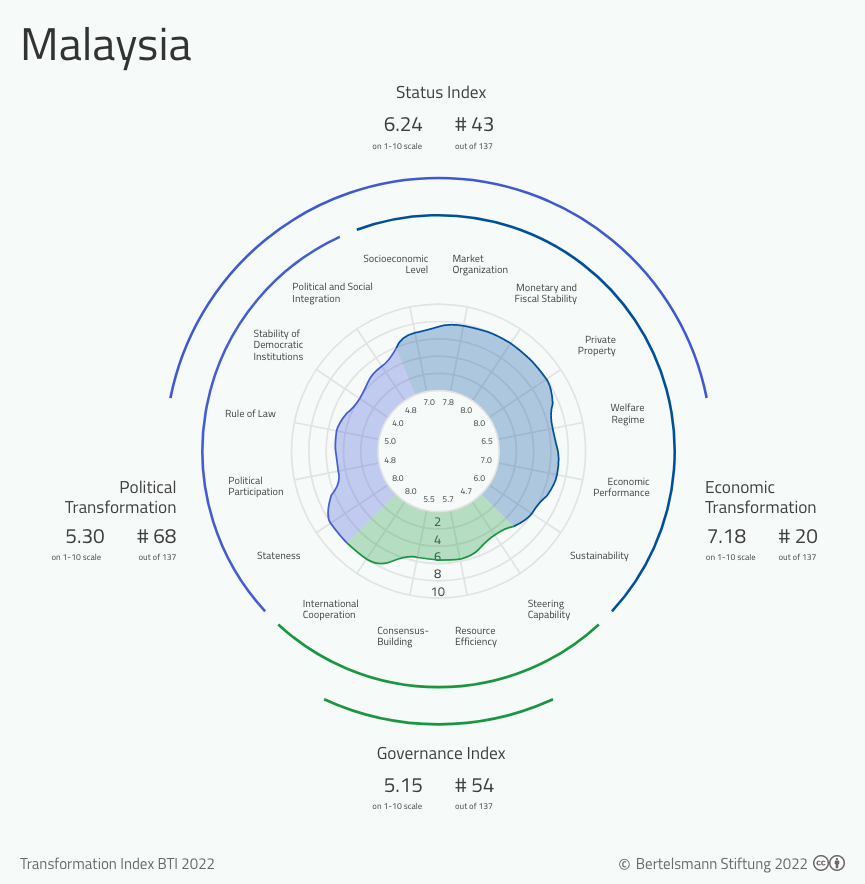

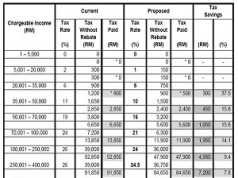

Assessment Year 2016 2017 Chargeable Income. A Firm Registered with the. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. On the First 2500. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Malaysia Personal Income Tax Rate was 30 in 2022. 15 percent and 28 percent.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information. Headquarters of Inland Revenue Board Of Malaysia. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

The system is thus based on the taxpayers ability to pay. Malaysia Income Tax Rates 2014 and 2015 and Deductions Malaysia Income Tax Rate for Individual Tax Payers. It also incorporates the 2018 Malaysian Budget proposals announced on 27 October 2017.

Malaysia Brands Top Player 2016 2017. However taxable income over certain levels was subject to a 33-percent tax rate to phase out the benefit of the 15-percent tax bracket as compared to the 28-percent rate and the deduction for personal exemptions. 2018 Personal Tax Incentives Relief for Expatriate in Malaysia.

Year Assessment 2017 - 2018. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25.

Historical Chart by prime ministers Najib Razak. Personal Income Tax Rate in. It should be noted that this takes into account all.

Tax Rate of Company. For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and expatriate employees are subject to a 50 rebate in their. 20172018 Malaysian Tax Booklet.

Rate Taxable Income Bracket Tax Owed. 10 of Taxable Income. Rate TaxRM A.

The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

How Large Is Corporate Tax Base Erosion And Profit Shifting A General Equilibrium Approach Eutax

Malaysia Corporate Income Tax Rate Tax In Malaysia

Malaysia Corporate Income Tax Rate Tax In Malaysia

U S Estate Tax For Canadians Manulife Investment Management

Latest Tds Rates Chart For Fy 2017 18 Ay 2018 19

Bti 2022 Malaysia Country Report Bti 2022

Cambodia Household Income Per Capita 2009 2022 Ceic Data

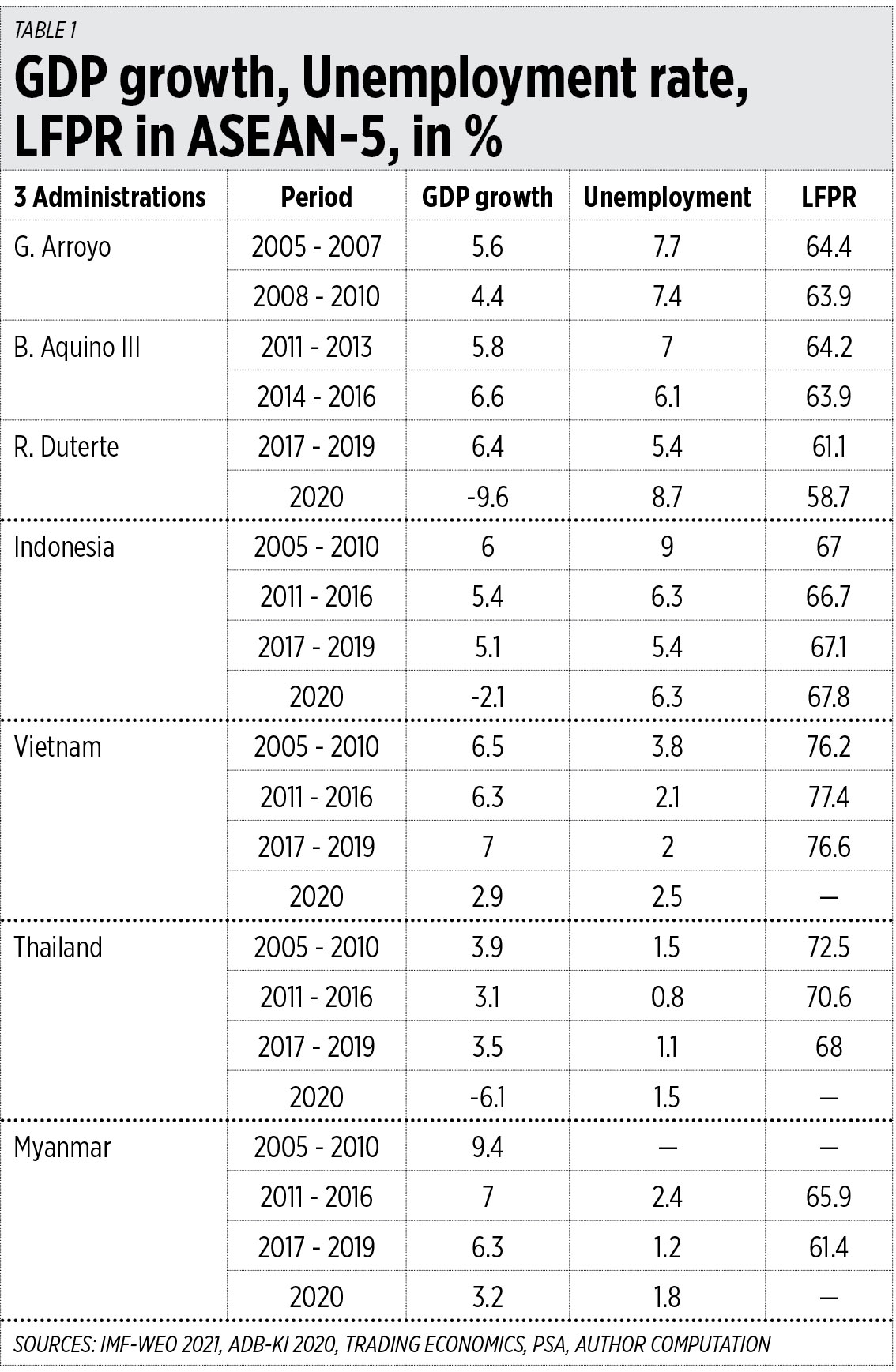

High Growth Under Pnoy Aquino And Tax Cuts Under Duterte Businessworld Online

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16283719/ff_subsidies.png)

Fossil Fuel Subsidies The Imf Says We Pay 5 2 Trillion A Year Vox

Malaysia Tax Revenue 1980 2022 Ceic Data

China Exports Of Electronic Technology July 2022 Data 2000 2021 Historical

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

U S Estate Tax For Canadians Manulife Investment Management

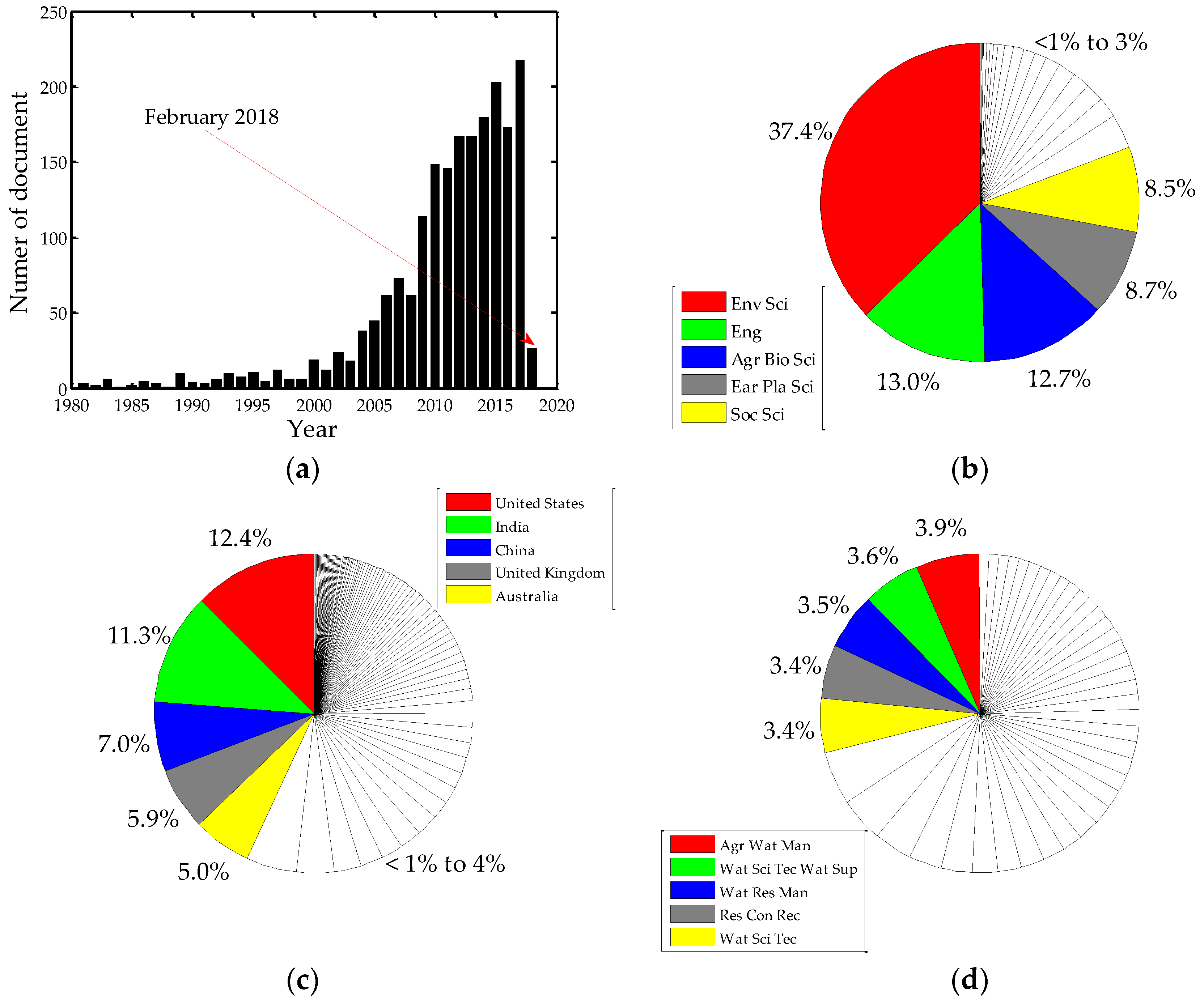

Water Free Full Text A Review Of Rainwater Harvesting In Malaysia Prospects And Challenges Html